The politics of energy—particularly oil and other fossil fuels—has long shaped international relations. Even as the global energy system undergoes transformation, with the clean energy transition underway, debates around energy security continue to hinge on fossil fuels. India, the world’s third-largest energy consumer, is particularly impacted by the vicissitudes of energy trade and geopolitical upheaval. This is underscored by recent developments, including US tariffs linked to India’s purchase of Russian oil and China’s weaponisation of clean energy supply chains.

Although energy features prominently in India’s key relationships and diplomatic dealings, there is no coherent strategy when it comes to energy-related engagement on the global stage. The past five years—marked by COVID-19, Russia’s invasion of Ukraine, China’s restrictions on renewable energy materials, and the US retrenchment of clean energy—demonstrate that the politicisation and weaponisation of energy flows is here to stay. In this environment, India must not only diversify its energy sources but also accelerate clean energy investments.

This essay asserts that India can enhance its global influence by strengthening its clean energy manufacturing base and exporting these capabilities. Domestically, prioritising investments in clean energy would allow industries to access cheaper power, support growth, reduce balance-of-payments pressures, and help achieve the goal of energy self-reliance by 2047. Externally, it would enhance economic and energy ties, provide leverage with countries anxious about energy security, and position India as a stabilising actor at a time when certain major powers are retreating from, or actively obstructing, global decarbonisation.

India’s clean energy transformation and growing potential

India’s energy demand is rising rapidly, with its share of global primary energy consumption projected to double by 2035. To meet growing demand alongside urbanisation and economic expansion, India has invested substantially in clean energy.

In 2024 alone, India installed nearly 30 GW of solar PV capacity—triple the additions in 2023. Reflecting improved policy and market conditions, the International Energy Agency (IEA) has revised India’s renewable capacity expansion for 2025-2030 upward by almost 10%. This trend could be aligned with the “rapidly accelerating uptake of solar power and other green technologies.” Capital flows mirror this trend, with the IEA estimating that over 80% of power sector investment in 2024 was cornered by clean energy.

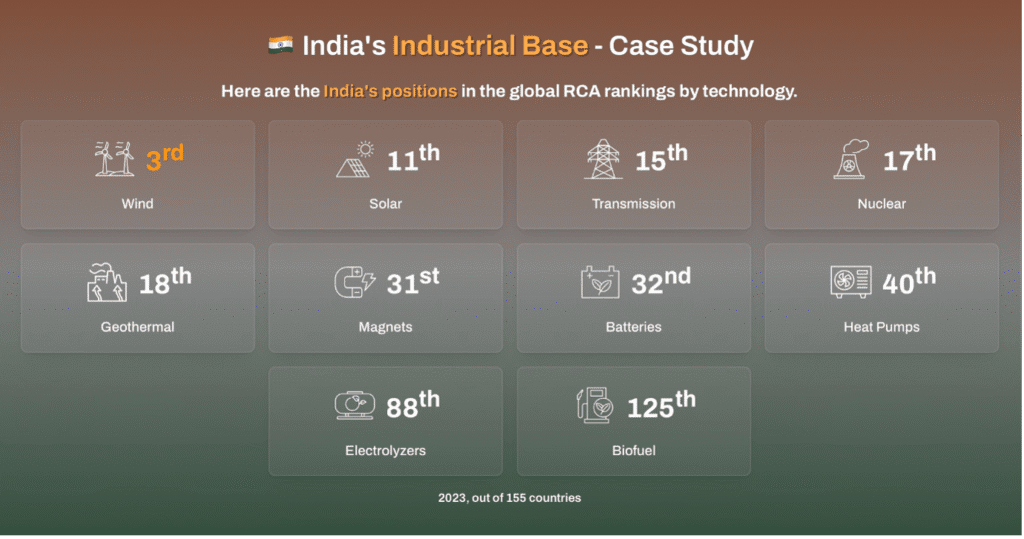

The Clean Industrial Capabilities Explorer—a novel machine learning tool developed by the Net Zero Industrial Policy Lab (NZIPL) at Johns Hopkins that maps revealed comparative advantage (RCA) across ten clean energy technologies—underscores India’s strong fundamentals. The analysis identifies five core capability sets—chemicals, electronics, industrial materials, machinery, and metals—as determinants of competitiveness.

According to the model, competitiveness in solar is driven fundamentally by abilities in metals, required for mounting structures and related materials, and chemicals, needed for polysilicon production and photographic plates (DOE). Wind competitiveness is determined by capabilities in chemicals, industrial materials, and metals. In short, permutations within the above-identified five sets of capabilities determine clean energy competitiveness for each selected technology.

India demonstrates strong competitiveness in biofuels, geothermal, nuclear, solar, transmission components, and wind (see Figure 1). This finding is significant. It suggests that India’s clean energy manufacturing potential may be stronger than commonly assumed, reinforcing the gains already visible in its domestic clean energy landscape.

Exporting clean energy in a fragmenting global order

India’s expanding manufacturing base is beginning to reflect in export data. In FY2024, photovoltaic module exports reached USD 2 billion—a more than twenty-fold increase in just two years. India is also a net exporter of wind generators, while exports of electric vehicles (EVs) and their components are steadily rising.

A detailed analysis reveals that India has the right fundamentals to be cost-competitive against non-Chinese players in the midstream manufacturing portion of clean energy value chains. Scholars have also identified components down to the four-digit HS code level where India can achieve export competitiveness in the short- to medium-term. Data for these select technologies, EVs, solar, and wind, illustrates that there is scope for India to enhance its exports. The NZIPL CICE model further reinforces this, as India has substantive RCA across ten clean energy technologies.

China’s dominance across clean energy supply chains remains the principal challenge. It is estimated that China produces close to 60% of EVs, 70% of wind turbine nacelles, 80% of solar modules, battery cells, and key processed minerals, and Chinese firms “have a significant lead on new nuclear power and green hydrogen.” However, this dominance has become a concern for all countries seeking to diversify supply chains and reduce dependencies. In a geopolitically fragmented world, this presents an opportunity for India.

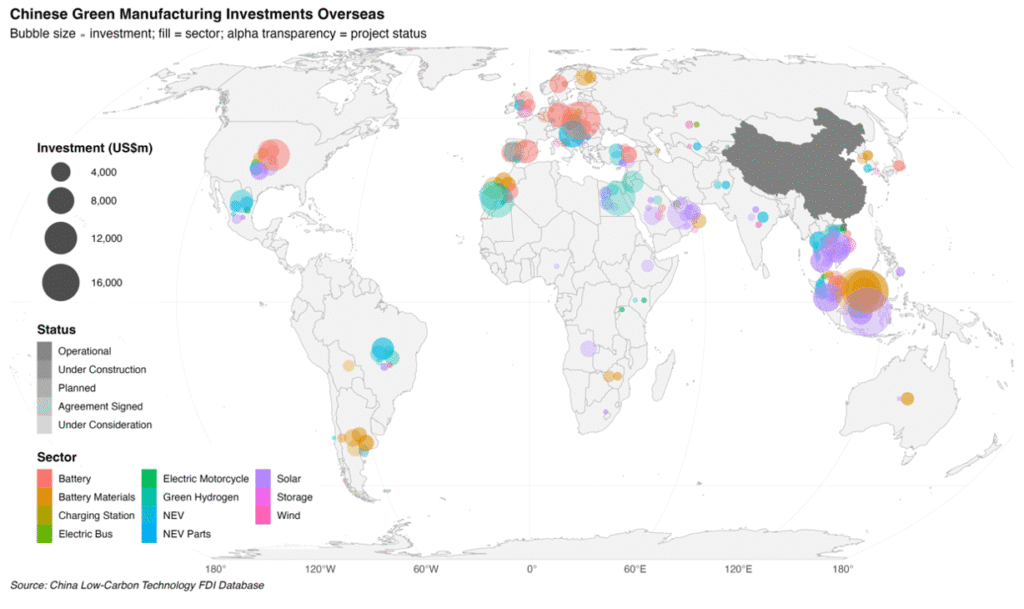

Even as Western powers scale back (or actively obstruct) decarbonization efforts, energy demand across Africa and Asia continues to grow. China has emerged as the partner of choice for many emerging markets looking for cheap and reliable clean energy products. This is due to China’s manufacturing capacity alongside Chinese firms’ active efforts to export clean energy products and invest in (and establish) clean manufacturing firms globally (Figure 2).

Ember estimates that China’s solar exports tripled between 2019 and 2024, with approximately half going to emerging markets. In 2024, a quarter of the USD 61 billion worth of batteries exported by China went to emerging markets, and these markets even surpassed the EU as China’s largest EV destination. The scale of these exports underscores both the demand for clean energy and the strategic value of supplying it, particularly in emerging markets.

India is well placed to tap this market. In addition to growing domestic manufacturing capacity and steadily rising exports, India has established global initiatives like the Coalition for Disaster Resilient Infrastructure, the International Solar Alliance, and the Global Biofuels Alliance.

India can actualise a global clean energy export strategy through three measures:

- Grant-in-aid and development projects: As per MEA data, India has provided over USD 4 billion in assistance spanning infrastructure, agriculture, health, and education projects to neighbouring countries. The Indian government could integrate clean energy manufacturing into grant-based and development projects, working with partner countries to meet energy needs while expanding opportunities for Indian firms. It is crucial that Indian manufacturers develop partnerships (direct investments, joint ventures, or technical training programs) with local firms in host countries.

- Export trade desks: The centre could support state governments in establishing stand-alone or integrated clean energy trade facilitation desks. For instance, the Tamil Nadu government has established investment facilitation offices in Germany, Japan, the US, and Vietnam. While these offices focus on facilitating investments inward, similar models can be adopted, or these offices can be strengthened to promote the bilateral exchange of clean energy products.

- Support domestic manufacturers access more markets: The MEA and the Ministry of Commerce and Industry should establish a dedicated platform for clean energy developers and manufacturers that convenes regularly to assess and identify export opportunities, address bottlenecks, and facilitate partnerships.

All three measures depend on sustained government support. This is crucial because Indian firms will compete with their Chinese counterparts that benefit from extensive government support. If India seeks to compete effectively in the clean energy transition, it must be prepared to commit substantial levels of capital and policy support.

From Energy Security to Global Influence

With geopolitics driving climate action, there is an energy security, economic, and environmental imperative for India to invest in its clean energy manufacturing base and to pursue a global export strategy in the medium- to long-term. Domestically, clean energy expansion would provide cheaper power, support industrial growth, advance climate goals, and conserve foreign exchange. Internationally, it would deepen economic ties, enhance India’s influence with energy-insecure states, and enable it to play a stabilising role in an increasingly fragmented global order.

India’s current capabilities and potential are underpinned by rising energy demand, investorconfidence, privatecapital, and, perhaps most importantly, political will at both national and statelevels. This convergence of domestic momentum and geopolitical flux presents a unique opening—one that India should seize, not only for its own development, but also to help stabilise a volatile global energy landscape.